In October 2019, the Reserve Bank of Australia (RBA) reduced the overnight money market interest rate (the cash rate) to 0.75%, a record low for recent times in Australia. The RBA has also indicated that it is prepared to ease monetary policy and reduce the cash rate further if necessary to support the desired economic growth.

Whilst unprecedented in Australia, negative interest rates have been seen in other jurisdictions. Euribor, the Euro Short-Term Rate (€STR) and the Swiss Average Rate Overnight (SARON) are each currently negative. The €STR and the SARON are the risk-free rates that will replace LIBOR for the Euro and the Swiss Franc. LIBOR has also previously been negative for both of those currencies as well as for the Japanese Yen.

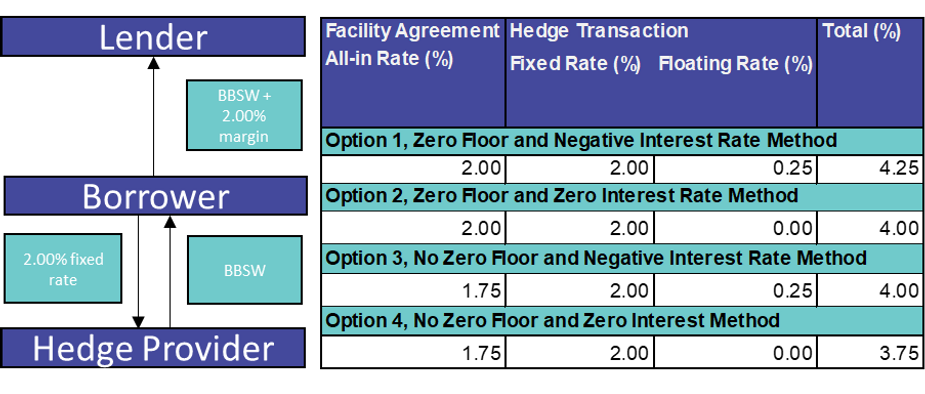

Lenders are protected from the effects of negative rates by including base rate “zero floors” in facility agreements and hedge providers are protected by the Negative Interest Rate Method in hedging documents. If a financing transaction contains both of these protections and the base rate falls below zero, borrowers will bear the associated increased financing costs (given that they do not benefit from the reduced all-in rate under the facility agreement and are also required to pay the value of the negative rate to the hedge provider under the hedging documents). Stronger borrowers might be able to negotiate against this position but, generally speaking, borrowers may need to start considering their hedging strategy in light of any voluntary or mandatory hedging of floating interest rate exposures.

Facility Agreements

In financing transactions with a floating interest rate, the all-in interest rate payable under the relevant facility agreement is the aggregate of a floating base rate and a fixed margin. The floating interest rate for loans in Australian dollars is generally based on either the Bank Bill Swap Rate (BBSW) (which is calculated by reference to market transactions between certain banks but is generally highly correlated to the cash rate) or the Australian Bank Bill Swap Reference Rate (Bid) (known as BBSY Bid) which is usually 5 basis points higher than BBSW with each rate being administered by ASX Benchmarks Pty Limited. The margin component is the lender’s return on the financing transaction. If the floating base rate was to reduce to such an extent that it became negative, that negative base rate would erode the margin and the lender would receive less than the agreed return for the transaction.

In order to mitigate this risk for lenders, the precedent facility agreements produced by the Asia Pacific Loan Market Association (APLMA) and also the London based Loan Market Association (LMA) include optionality for the inclusion of a “zero floor” in the definitions of the various floating base rates.

The inclusion of the zero floor is ultimately a commercial point to be agreed during the negotiation of the facility agreement. If included, a zero floor has the effect of limiting any downward movement of the base rate such that, if the base rate is less than zero, the base rate will be deemed to be zero for the purpose of the facility agreement. As such, the lender will always receive the full margin and the return it had anticipated at the commencement of the financing transaction.

In the context of negative base rates, the worst-case scenario for a lender would be when the negative base rate exceeds the margin such that the overall interest rate under a facility agreement is negative. In these circumstances and where the facility agreement does not include a zero floor, it raises the question of whether the lender would be liable to pay interest to the borrower. In the APLMA and LMA precedent facility agreements, the interest provisions include a one-way obligation on the borrower to pay accrued interest to the lender. This could be interpreted in such a way that these documents have an embedded all-in rate floor as there is no obligation on the lender to make interest payments to the borrower. This one-way payment obligation is different to hedging documents where there are reciprocal payment obligations.

Hedging Documents

Borrowers often choose, or are required by covenants in a facility agreement, to enter into interest rate swaps (also known as hedges) to protect against increased floating interest rates. Under such hedging transactions, the borrower will be liable to pay the hedge provider a fixed rate of interest in exchange for a floating rate that will satisfy the borrower’s interest payment obligations under the relevant facility agreement.

As with the APLMA and LMA, the International Swaps and Derivatives Association (ISDA) has also addressed the scenario of negative interest rates. The two relevant regimes under the ISDA swap documents are the ‘Negative Interest Rate Method’ and the ‘Zero Interest Rate Method’.

The Negative Interest Rate Method will automatically apply to all swap documents that incorporate the 2006 ISDA Definition unless specifically excluded. Under this method, the floating rate payer (typically the hedge provider in a facility backed ISDA) would ordinarily be required to pay a certain amount in respect of the floating leg of the interest rate. However, if on a payment date under the ISDA document, the floating rate (and therefore amount payable) is a negative number then the floating rate payer will be deemed not to owe anything and, instead, the fixed rate payer (the borrower under the financing transaction) will be obliged to pay the hedge provider an amount equal to the value of the negative floating amount.

If the parties specify that the Zero Interest Rate Method will apply to the swap transaction, this method will relieve the floating rate payer from the obligation to pay any negative floating rate but there is no obligation on the fixed rate payer to make payment of the negative floating amount.

Mismatch

In practice, it has become market for lenders to require a zero floor in facility agreements and the Negative Interest Rate Method is the current market method for swap transactions as this is the method typically applied by interbank hedge providers.

In circumstances where there is a negative base rate, it is the combination of a zero floor and the Negative Interest Rate Method that might create a mismatch and adversely affect borrowers. This is because:

-

under the facility agreement, the borrower will still be obliged to pay the full margin rather than having the benefit of a reduced all-in rate pursuant to base rate fluctuations; and

-

under the hedge documents, in addition to having to pay the fixed leg portion, the borrower will also be liable to pay the amount of the negative floating rate portion to the hedge provider rather than receiving the floating rate portion from the hedge provider (where the base rate is above zero) or otherwise not being required to pay this amount pursuant to the Zero Interest Rate Method.

A worked example for the various possibilities for amounts that will have to be met by a borrower under a facility agreement and hedge documents, assuming a decrease in BBSW to – 0.25% and a margin of 2.00%, is as follows:

Takeaways

Stronger borrowers might be able to negotiate—zero floors out of their facility agreements,

only having zero floors apply to the all-in interest rate, only having a zero floor apply to those facilities where hedging has not been taken out or, otherwise, utilising the Zero Interest Method under its hedging documents.

If one of these positions cannot be reached, any mismatch and associated additional financing costs will most likely be borne by the borrower. On this basis and given the possibility of negative base rates in the global lending market, borrowers should give thought to, and develop a strategy with respect to, the effect of negative interest rates and zero floors on their financing and hedging transactions (including considering whether a fixed interest rate may be more appropriate for their financing transactions).

The Banking and Finance Team at Hamilton Locke is experienced in acting for both lenders and borrowers in financing transactions and the negotiation of the relevant documents and can provide you with strategic advice about how best to position yourself in the current market. Please contact Zina Edwards or Lauren Cloete if you would like to discuss.