As the world shifts towards more sustainable energy solutions, Virtual Power Plants (VPPs) have become a significant innovation in the energy sector representing a new way of managing and optimising energy resources. This article explores five key aspects of VPPs, offering insights into what they are, how they operate, their regulatory landscape in Australia, their current status and what will drive their future development.

-

What is a Virtual Power Plant (VPP)?

A Virtual Power Plant (VPP) is a sophisticated energy management system that aggregates various Distributed Energy Resources (DERs) and flexibly aligns energy supply with demand. DERs can include solar panels, wind turbines, batteries, electric vehicles (EV), and demand response systems distributed across multiple locations. VPPs effectively bundle these separate resources and engage as a single entity in the energy market.

-

How does a VPP operate?

VPPs continuously monitor real time data from each connected asset and analyse the data using advanced algorithms to optimise the dispatch of energy. This ensures efficient utilisation of available resources and minimises reliance on traditional power plants during peak demand. This is possible due to advancements in technologies such as the Internet of Things, artificial intelligence, and real-time data analytics.

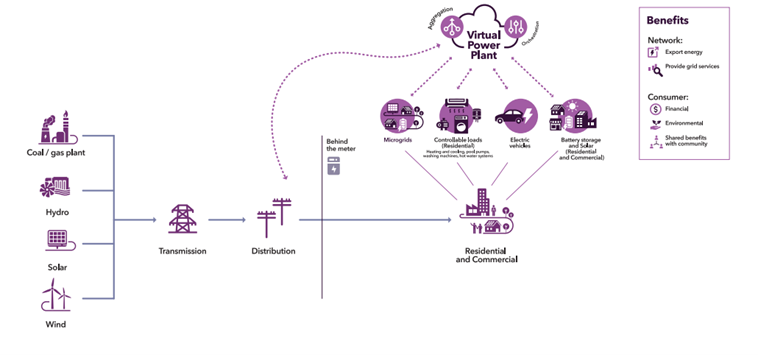

The below graphic illustrates how energy produced behind the meter (BTM) is aggregated from residential and commercial entities connected to a VPP. VPPs can remotely control DERs for the most efficient utilisation of energy and optimise operation based on factors such as energy market prices, grid conditions, and user preferences.

VPPs can generate revenue under local network services agreements with local distributors to supply energy. Further, as an energy retailer, VPPs can buy energy from the grid when the wholesale spot price is low and sell electricity to the grid when the spot price is high. The bi-directional flow of energy from the VPP to the grid distribution network is reflected in the graphic below. By matching supply and demand, VPPs can achieve a dual purpose of stabilising the grid and maximising profit.

VPPs can also provide ancillary services to the grid, such as frequency regulation and voltage control.

Virtual Power Plants schematic overview. Source: AEMO NEM Virtual Power Plant Demonstrations Report, September 2021.

-

Who regulates VPPs in Australia?

VPPs are required to comply with National Electricity Laws (NEL). Given the adoption of VPPs is still relatively new in the market, regulators are catching up on how to create an effective regulatory framework to ensure grid reliability, promote energy security and safeguard the interests of all stakeholders.

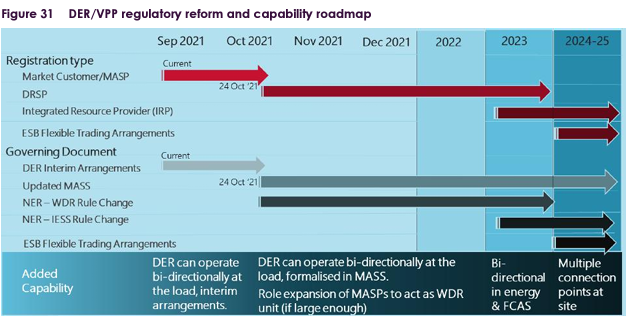

Between 2019 and 2021, AEMO led VPP demonstrations across Australia to understand the capability of VPPs to deliver across multiple value streams across FCAS, energy and potential network support services.1 Amongst the other objectives, the demonstrations were designed to inform changes to regulatory frameworks and operational processes so DERs can be effectively integrated into the NEM. A key finding was the importance of AMEO having operational visibility of VPPs for the efficient management of energy resources. The demonstrations were only the first step, and was followed by Project EDGE to test the feasibility of a DER marketplace within the constraints of the distribution network. The trials have led to important rule changes plotted in the timeline below and further regulatory reforms are planned to better integrate DER resources into the grid. In the 2024 ISP plan, AEMO indicated hope that trials like Project EDGE will give consumers the confidence to connect their DER assets to VPPs.2

DER/VPP regulatory reform and capability roadmap. Source: VPP Knowledge Sharing Report #4 – Final Report, September 2021 (AEMO)

-

The status of VPPs in Australia

There are currently around 18 commercially available VPP products in the NEM.3 While current profit margins for operators are thin, energy retailers without VPP capabilities are expected to struggle to be profitable in the future.4 Most of the prominent energy service providers have already entered the VPP market, and are offering packages that includes the installation of solar panels and battery storage systems, along with energy management software to monitor and control energy usage. Participants can benefit from reduced energy bills and increased energy security through backup power during outages.

-

What will drive the future development of VPP?

The future development of VPPs is expected to be primarily driven by an increased adoption of EVs, expanding rooftop solar and battery storage in commercial and industrial settings. Energy retailers tend to market VPP products as part of a package to increase the market penetration of their VPP platforms. By offering payment plans and incentives (in the form of cashback schemes and energy credits), energy retailers are increasing the uptake of DERs by lowering the up-front costs for households.

The interest in VPPs by energy retailers and consumers is seen in the industry as a natural evolution of advancements in renewable technology. The advancements in Battery Energy Storage Systems (BESS) have created an opportunity for VPPs to enter the market to maximise the value of new storage capabilities.

Developers are integrating BESS into their large energy projects to maximise their future revenue streams, and we’re already seeing significant deals in the distributed energy market that will change the future energy landscape (for example, the recent Birdwood Energy Distributed Energy Partnership with Aware Super).

Other key drivers for the adoption of DERs and in turn the adoption of VPP include the planned decommissioning of traditional utility scale energy providers (such as thermal power plants), further advancements in technology and increasing economics of scale in the sector.

VPPs represent a paradigm shift in the way we generate and consume electricity. By harnessing the power of advanced technologies and DERs, VPPs offer a pathway to a more sustainable, resilient, and efficient energy future.

The Hamilton Locke team advises across the energy project life cycle – from project development, grid connection, financing, and construction, including the buying and selling of development and operating projects. For more information, please contact Matt Baumgurtel.

1AEMO, ‘Virtual Power Plant (VPP) Demonstrations’, (Web page) <https://aemo.com.au/en/initiatives/major-programs/nem-distributed-energy-resources-der-program/der-demonstrations/virtual-power-plant-vpp-demonstrations.

2AEMO, ‘2024 Integrated Systems Plan’ (Web page, 2024) <https://aemo.com.au/energy-systems/major-publications/integrated-system-plan-isp/2024-integrated-system-plan-isp>

3SunSolar quotes, Virtual Power Plant (Vpp) Comparison Table (Web page, 18 March 2024) <https://www.solarquotes.com.au/battery-storage/vpp-comparison/>; Gabrielle Kuiper, ‘What Is the State of Virtual Power Plants in Australia? From Thin Margins to a Future of VPP-tailers’ (2022), Institute for Energy Economics and Financial Analysis, <https://ieefa.org/wp-content/uploads/2022/03/What-Is-the-State-of-Virtual-Power-Plants-in-Australia_March-2022_2.pdf>

4Ibid.