It is likely other States and Territories will be carefully watching Victoria as its new Commercial and Industrial Property Tax (CIPT) comes into effect from 1 July 2024, taking a step towards abolishing stamp duty on land in the state.

Depending on the outcome of the CIPT implementation and the resolution of any teething issues, it is highly likely that, if successful, we will see a gradual creep of the property tax model across jurisdictions (as was the case with the introduction of foreign surcharge duty and land tax, which has now been implemented in most jurisdictions).

There will no doubt be practical and administrative questions which arise once the CIPT regime fully gets underway. We have summarised the key points that advisers and landowners need to know ready for 1 July 2024.

What are the changes?

From 1 July 2024, the purchase of Victorian commercial and industrial property will trigger the property to come within the ambit of the CIPT regime. Once the land has entered the scheme it will be referred to as ‘tax reform scheme land’.

This will not occur automatically, but will be triggered in circumstances where the land has a ‘qualifying use’ and one of the following transactions occurs:

- Entry Transaction

The acquisition of an interest of 50% or more in the land (either directly by way of a transfer of the land) or indirectly (where an interest is acquired of 50% or more of the shares or units in a Victorian landholder).

- Entry subdivision

Occurs where land is tax reform scheme land and is subdivided. The new subdivided lots will be taken to be tax reform scheme land on their creation.

- Entry consolidation

Will occur where there is consolidation of land which is all tax reform scheme land or where tax reform scheme land is consolidated with non-tax reform scheme land. An entry consolidation into the scheme will only occur in circumstances where more than 50% of the consolidated land (calculated based on land area) is tax reform scheme land.

To the extent a transfer duty or landholder duty exemption would apply to the transaction, this will not trigger the land becoming subject to CIPT.

Land will become ‘tax reform scheme land’ on the date of the transaction (i.e. settlement date for land transfers or the acquisition date for relevant shares or units). This means that any subsequent transfer or acquisition of tax reform scheme land should not trigger duty (subject to certain conditions and circumstances).

This article further considers the impact of the CIPT specifically related to Entry Transactions involving the direct acquisition of land.

When does land have a ‘qualifying use’?

The CIPT will only apply to land with a qualifying use, as determined by the Australian Valuation Property Classification Code (AVPCC). The land must be coded by the Valuer General as either:

- commercial;

- industrial;

- extractive industries;

- infrastructure and utilities property; and

- certain land used for eligible student accommodation.

If the relevant land has a mixed use, the Commissioner will adopt a sole or primary use test to determine whether the land has a qualifying use.

What happens when CIPT is triggered?

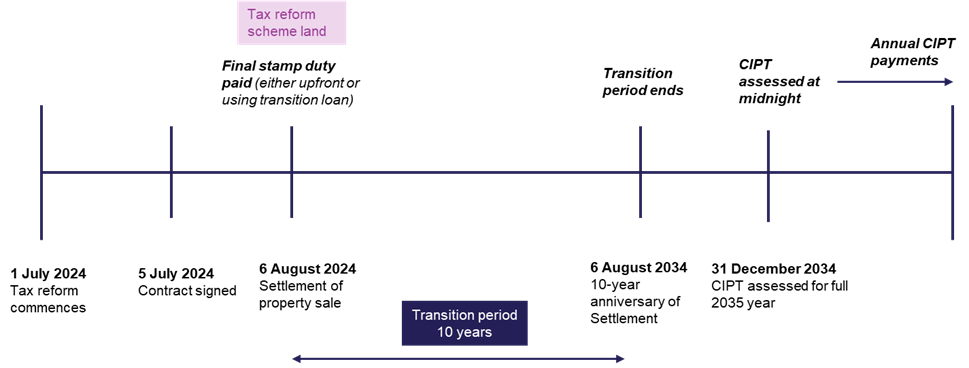

On purchase or acquisition of land with a qualifying use, a final round of duty will be triggered, which will be required to be paid by the purchaser upfront (as per usual), or the purchaser may opt to access a government-facilitated transition loan to fund the payment of transfer duty on commercial terms across 10 years (i.e. the stamp duty amount plus interest) (Transitional Loan). The land will then be classified as tax reform scheme land (otherwise referred to as CIPT land).

The purchase of the CIPT land will start a clock ticking and an annual CIPT will become payable 10 years from the date the property entered into the CIPT regime.

The rate of CIPT will be a flat rate of 1% of the unimproved value of the land, payable annually. For build-to-rent land (which qualifies for a build-to-rent land tax benefit) the rate will be 0.5%.

It is important to note that the CIPT is separate and distinct from land tax – that is, once the CIPT comes into effect over the land, the owner of the land will pay CIPT (once the 10-year transition period has passed) and land tax annually (as applicable).

Example of timeline from CIPT application

How will CIPT be assessed?

CIPT will be assessed on the land owned as at midnight on 31 December each year (in a similar way that land tax is assessed). However, note that CIPT is an additional and separate tax to land tax or any other existing taxes that apply to land in Victoria.

There is a 10-year transition period once the land becomes part of the regime before the first round of CIPT will be assessed.

In summary, CIPT applies to land that:

- has entered the tax reform scheme (i.e. purchased after 1 July 2024);

- is no longer within its 10-year transition period (commencing the date it entered the scheme);

- has a qualifying use (discussed below) as at midnight on 31 December; and

- is taxable land within the meaning of the Land Tax Act 2005.

Who is liable for CIPT?

The registered owner of the land at the time it has entered into the tax reform scheme will be liable to pay the annual CIPT (or any subsequent owner).

Lessees of long-term (non-Crown leases) granted prior to 1979 are also deemed to be owners. These long-term lessees may have a statutory liability for CIPT purely because the lessor disposes of the freehold land after 1 July 2024.

Advisers and landowners – Key points to consider

- Landowners and advisors need to be aware that other transactions can trigger movement into the CIPT regime – consolidations, subdivisions, share and unit acquisitions and advise clients accordingly, as additional reporting and compliance obligations may be required.

- The Commissioner will have the power to recover unpaid CIPT from third parties which have a connection with the land (including a lessee, occupier or mortgagee). There are however restrictions imposed to pass on CIPT to lessees or tenants.

- Where the property has a mixed use, there is no provision for apportionment. It will be based on the sole or primary purpose of the land.

- A change in the use of the land can trigger duty and CIPT implications. Advisers and landowners need to consider land use and whether any implications will arise where significant changes to business activities or use will create a notification obligation. If a change does occur, the Commissioner must be notified within 30 days from the date the change occurred.

- If a land sale contract in Victoria is likely to complete after 1 July 2024 (notwithstanding the contract may have already been signed), there may be transfer duty and CIPT implications for this transaction and specialist advice should be obtained (if not already provided).

- From 1 July 2024, all purchasers (including real estate purchases and commercial transactions involving shares and units in a landholder) should ensure that their due diligence procedures take into account determining the CIPT status of any land. Clearance certificates should be obtained and advice obtained where there is unpaid CIPT listed on the certificate.

Stay informed and get prepared

Stay informed and prepared for the changing landscape of property taxation. As the implementation of the CIPT unfolds, it’s crucial for landowners, advisors and stakeholders to stay abreast of updates and developments. Seek expert guidance to navigate the complexities of the new regime and ensure compliance with reporting and compliance obligations. For personalised advice tailored to your specific situation, don’t hesitate to reach out to our team.