The maritime industry is on a journey to decarbonise. Currently accounting for approximately 3% of the world’s total CO2 emissions, the shipping sector is facing mounting societal and regulatory pressure to transition to more sustainable practices.1

In this article, we explore the types of traditional and alternative marine fuels, give an overview of the changing attitudes towards alternative fuels and highlight the changes in the regulatory landscape.

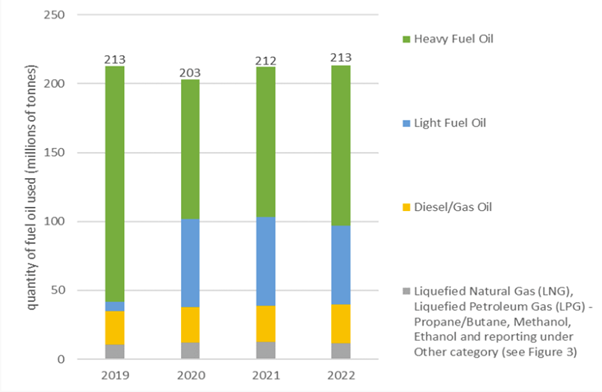

Currently, the most common marine fuels are Heavy Fuel Oil (HFO), Light Fuel Oil and Diesel / Gas Oil (together, Traditional Marine Fuels) (see below).2

These Traditional Marine Fuels emit around 1 gigatonne of greenhouse gas (GHG) emissions per year, including sulphur oxides (SOx) and nitrogen oxides (NOx), which account for approximately 2.5% of global GHG emissions annually.3

The International Maritime Organization (IMO) has set a goal of achieving net-zero emissions by approximately 2050, with a short-term goal of having zero, or near-zero, GHG emission technologies, fuels, or energy sources making up at least 5% of the fuel mix.4 Accordingly, there are a number of alternative marine fuels which are being pursued as low-GHG alternatives (Alternative Marine Fuels).

Types of Alternative Marine Fuels

Ammonia

Ammonia is a mix of nitrogen and hydrogen, which does not emit any CO2 during combustion. Ammonia has half the energy density of Traditional Marine Fuels (though higher than hydrogen) and is highly toxic, flammable, and corrosive, which necessitates specialised storage and handling.5 However, green-ammonia production should scale with the continued uptake of renewable energy and additional benefits from the existing infrastructure resulting from its use in agriculture.

Liquefied Natural Gas

Liquefied Natural Gas (LNG) is natural gas cooled to a liquid state, making it more compact for storage and transport. As a marine fuel, LNG offers significant environmental advantages, including lower emissions of SOx and NOx, compared to traditional HFO.6 However, LNG is still a fossil fuel and sits between the potential future fuels like ammonia, hydrogen or methanol, and Traditional Marine Fuels. As a result, it is seen as a bridging fuel that can help achieve emission reduction targets while the use of Alternative Marine Fuels are being scaled up.7

Biofuels

Biofuels, which are derived from organic materials such as plant oils, animal fats and recycled cooking oils, present an alternative to fossil fuels for the maritime sector. Biofuels can significantly reduce greenhouse gas emissions, with some biofuels offering up to an 80% reduction in GHG emissions compared to conventional fuels.8 However, the sustainability of biofuels depends on the ability to preserve their source. For example, using crops for fuel can compete with priority for food production and lead to deforestation. Additionally, the maritime sector is in direct competition with the uptake of sustainable aviation fuel (SAF).9 SAF is produced from the same cooking oils and animal fat waste used to create marine biofuels. Although SAF has higher production costs than marine biofuels, the aviation industry’s margins are better suited to absorbing or passing on the costs, meaning the aviation industry is likely to absorb a majority of supply moving forward.10

Hydrogen

Hydrogen is a ‘zero-emission fuel’, making it a highly attractive option for the maritime industry’s decarbonisation. Hydrogen combustion produces very little NOx, no SOx and no carbon dioxide (CO2) emissions. However, it is one of the least energy dense fuel sources by volume (raising operating expense concerns) despite having high energy content by weight.11 Hydrogen storage and handling also pose significant challenges, requiring advanced storage solutions such as cryogenic tanks, and the conversion of hydrogen via compression, liquefaction, or chemical compounding.12 There is no one size fits all solution to storage, as no single storage method is capable of housing high density energy without expending large amounts of energy to safely store that energy.13 As a result shipowners are facing high capital expenditure costs associated with transitioning to hydrogen including costs associated with fitting and maintaining the required storage and engines for hydrogen use, as well as production, conversion and training-related costs.

Methanol

Methanol, a liquid at ambient temperatures, offers a practical alternative marine fuel due to its ease of storage and handling. It can be produced from various feedstocks, including natural gas, biomass, and even CO2. Methanol combustion results in lower emissions of SOx, NOx, and particulate matter compared to Traditional Marine Fuels. However, methanol has a lower energy density than HFO, necessitating larger storage volumes on ships. Additionally, methanol production is extremely limited.14

Changing attitudes – Decarbonisation efforts

In 2023, the Global Centre for Maritime Decarbonisation and Boston Consulting Group conducted an industry survey with 128 shipowners and operators who collectively owned or operated over 14,000 merchant vessels.15 While 73% viewed getting to net-zero operations as a strategic priority, the lack of commercial incentives and low economic viability of these fuels have been identified as one of the leading challenges for adoption.16 Specifically, Alternative Marine Fuels require investment from shipowners to build, or retrofit, their vessels to use such fuels,17 attract a premium over conventional fuels, require higher-skilled labour to operate and have a lower energy density.18

Regulations supporting the transition

The IMO’s goal of achieving net-zero emissions by approximately 2050 are supported by the following climate policies:

- US Inflation Reduction Act – the US Inflation Reduction Act incentivises developers and investors to produce Alternative Maritime Fuels through providing tax credits for the production of clean hydrogen, and additional credits for carbon sequestration.19

- EU Emissions Trading System – the EU Emissions Trading System acts as a cap-and-trade program which now applies to the maritime and aviation industries. It requires companies to purchase allowances (a right to emit a certain amount of GHGs) if their vessels travel within the EU.20 This program, over time, will increase the price of these allowances which incentives vessel owners to transition to Alternative Marine Fuels.21

- FuelEU Maritime Regulation – the FuelEU Maritime regulation (entering into force in 2025) sets GHG emissions intensity requirements on the energy used by ships over 5000 gross tonnage trading in the EU, targeting a 2% decrease in GHG by 2025, and an 80% decrease by 2050.22 Notably, this target does not just cover CO2 emissions, but undertakes a full lifecycle assessment of the fuels used onboard, from well-to-wake.23

- FuelEU pooling mechanisms – the FuelEU pooling mechanism under the Fuel EU Maritime Regulation allows for vessel in compliance with the set annual GHG targets to share any extra allowance or surplus GHG emission with other vessels. In this sense, overachieving vessels are able to monetise on compliance – or fleet owners may take a broader view of their fleet’s compliance in line with the policy. However, there is not currently a government run marketplace for the surplus.24

What does the future hold?

The shipping sector is being driven by both penalties and incentives to adopt Alternative Marine Fuels. This combination of regulatory pressure, and growing understanding and investment into the production and storage of biofuels, methanol and hydrogen derivative products will continue to propel the shipping sector to transition away from Traditional Marine fuels. The challenges facing shipowners are notable and the apprehension is warranted. However, as the transition continues shipowners will need to determine (perhaps irrespective of the commercial viability) when, not if, they will adopt more widespread use of Alternative Marine Fuels.

The Hamilton Locke team advises across the energy project life cycle – from project development, grid connection, financing, construction, including the buying and selling of development and operating projects. For more information, please contact Hamilton Locke New Energy Partner Matt Baumgurtel.

1World Economic Forum, ‘Reducing barriers to maritime fuel projects is key to decarbonizing shipping’ (18 April 2024) <https://www.weforum.org/agenda/2024/04/why-reducing-barriers-for-maritime-fuel-projects-is-key-to-progressing-on-decarbonization/>.

2Future Fuels and Technology Project, International Maritime Organization, ‘Report on annual carbon intensity and efficiency of the existing fleet’ (2022) <https://futurefuels.imo.org/home/latest-information/fuel-consumption-dcs/>.

3Maersk Mc-Kinney Moller Center, ‘Maritime Decarbonization Strategy 2022’ (8 December 2022) https://www.zerocarbonshipping.com/publications/maritime-decarbonization-strategy/; Methanol Institute, ‘Measuring Maritime Emissions: Policy Recommendations Regarding GHG Accounting of the Maritime Industry’ (August 2021) https://www.methanol.org/wp-content/uploads/2021/11/Methanol-Institute-Measuring-Maritime-Emissions-Policy-Paper-August-2021.pdf

4International Maritime Organization, RESOLUTION MEPC.377(80) (7 July 2023) https://wwwcdn.imo.org/localresources/en/MediaCentre/PressBriefings/Documents/Clean%20version%20of%20Annex%201.pdf.

5Global Maritime Forum, ‘Ammonia as a shipping fuel’ (14 March 2022) https://globalmaritimeforum.org/insight/ammonia-as-a-shipping-fuel/.

6The International Council on Clean Transportation, ‘The Climate Implications of using LNG as a Marine Fuel’ (28 January 2020) https://theicct.org/publication/the-climate-implications-of-using-lng-as-a-marine-fuel/.

7Wartsila, ‘LNG as fuel for ships: expert answers to 17 important questions’ (19 June 2024) https://www.wartsila.com/insights/article/lng-fuel-for-thought-in-our-deep-dive-q-a.

8Hui Xu et al, ‘Life Cycle Greenhouse Gas Emissions of Biodiesel and Renewable Diesel Production in the United States’ (2022) https://pubs.acs.org/doi/10.1021/acs.est.2c00289.

9World Economic Forum, ‘Climate goals: airlines are pinning their hopes on sustainable aviation fuel’ (11 December 2023) https://www.weforum.org/agenda/2023/12/airlines-sustainable-aviation-fuel-carbon-targets/.

10Lynn Loo et al, ‘Voyaging toward a greener future: Insights from the GCMD-BCG Global Maritime Decarbonization survey’ (September 2023) https://www.bcg.com/publications/2023/voyaging-toward-a-greener-maritime-future.

11Shipping Australia, ‘Hydrogen fuel, clean, plentiful and not ready (2021) https://www.shippingaustralia.com.au/wp-content/uploads/2021/08/Shipping-Australia-Winter-2021-Future-Fuels-Hydrogen-not-read.pdf.

12Laurens Van Hoecke et al, ‘Challenges in the use of hydrogen for maritime applications’ (2021) 14 Energy & Environmental Science https://pubs.rsc.org/en/content/articlehtml/2021/ee/d0ee01545h; ‘Hydrogen fuel, clean, plentiful and not ready’ (n 11).

13 ‘Challenges in the use of hydrogen for maritime applications’ (n 12).

14‘Maritime Decarbonization Strategy’ (n 3).

15‘Voyaging toward a greener future’ (n 10).

16‘Voyaging toward a greener future’ (n 10).

17Though, consider, Maersk Mc-Kinney Moller Centre, ‘Preparing Container Vessels for Conversion to Green Fuels’ (28 September 2022) https://www.zerocarbonshipping.com/publications/preparing-container-vessels-for-conversion-to-green-fuels-2/.

18Ibid.

19U.S. Energy Information Administration, ‘Issues in Focus: Inflation Reduction Act Cases in the AEO2023’ (16 March 2023) <https://www.eia.gov/outlooks/aeo/IIF_IRA/>.

20Maersk Mc-Kinney Moller Center, ‘Transatlantic Testing Ground; Assessing impacts of EU and US policies on accelerated deployment of alternative maritime fuels’ (January 2024) <https://www.zerocarbonshipping.com/publications/assessing-impacts-of-eu-and-us-policies-on-accelerated-deployment-of-alternative-maritime-fuels/>.

21Ibid.

22Directorate-General for Mobility and Transport, European Union https://transport.ec.europa.eu/transport-modes/maritime/decarbonising-maritime-transport-fueleu-maritime_en

23Ibid.

24Maersk Mc-Kinney Moller Center, ‘FuelEU Explainer: Pooling and the Business Case for Green Shipping’ (24 April 2024) https://www.zerocarbonshipping.com/news/explainer-pooling-and-the-business-case-for-green-shipping/