Hamilton Locke has excelled in the 2023 Australian ECM and M&A rankings recently released in LSEG (previously Refinitiv), Mergermarket and WA Business News.

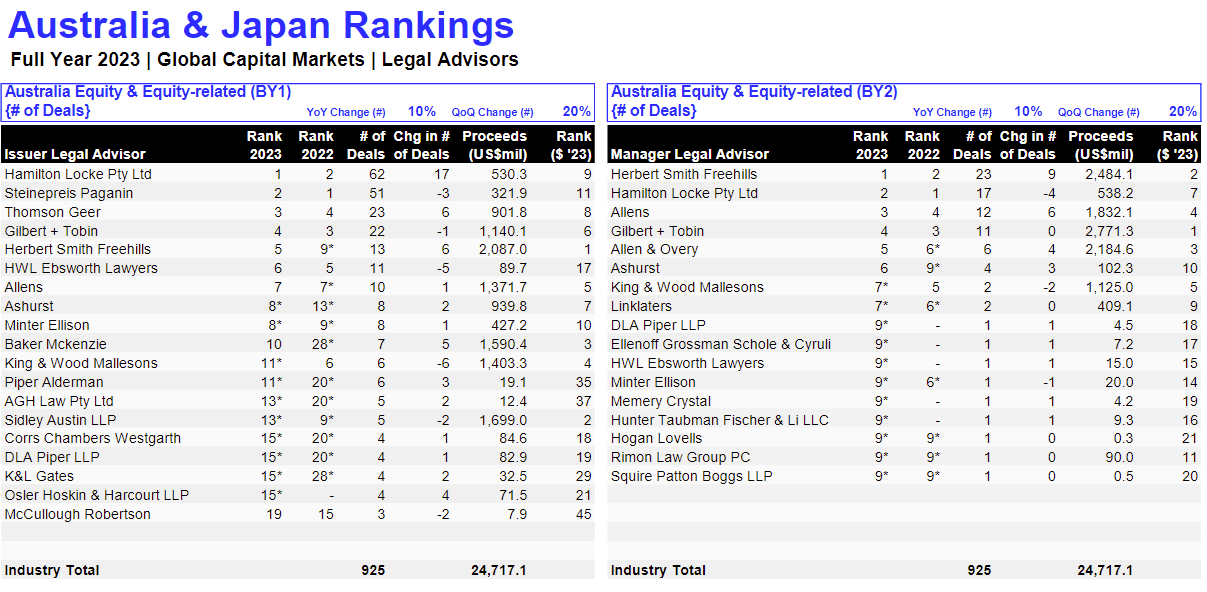

We have proudly topped the Australian ECM and M&A rankings advising on deals for issuers and lead managers in the Global Capital Markets Legal Advisory Review 2024 released by LSEG. Hamilton Locke ranked 1st in Australia for the highest deal count in 2023, advising issuers on 62 deals valued at over USD530 million. Additionally, we have ranked 2nd for advising lead managers on 17 deals valued at over USD530 million. To view LSEG’s 2023 Global Capital Markets Legal Review, click here or refer to Figure 1.

Figure 1: LSEG Global Capital Markets Legal Review Full Year 2023

In Mergermarket’s 2023 Global & Regional M&A Rankings, we ranked 6th in Australia for the highest volume of M&A deals, with 69 deals valued at USD738 million. This is the firm’s highest Mergermarket ranking and a significant jump from 13th place in 2022. (Refer to Figure 2)

Figure 2: Mergermarket Global & Regional M&A Rankings 2023

Additionally, WA Business News – a highly regarded publication in the Perth business community – released their Corporate Finance feature this week and recognised Hamilton Locke for advising on both the highest volume of M&A deals and ECM deals amongst Western Australian law firms. (Refer to Figures 3 and 4)

WA Business news noted that Hamilton Locke handled the majority of ECM deals and advised on 44 deals worth $1.31 billion and 79 worth $1.12 billion, respectively.”

Figures 3 and 4: WA Business News

A snapshot of some of the capital markets deals we advised on nationally include:

- Advised Canaccord Genuity, as joint lead manager and underwriter with Argonaut Securities, on De Grey Mining’s $300 million two tranche placement.

- Advised Cettire and its Founder, CEO and controlling shareholder on the $100 million underwritten block trade of shares representing 9% of the company.

- Advised Canaccord Genuity as lead manager and underwriter on Brazilian Rare Earths’ $60 million IPO and ASX listing.

- Advised Adriatic Metals on its $32 million placement.

- Advised Armour Energy on its fully underwritten $32 million capital raising.

- Advised Avecho on its $11 million non-renounceable entitlement offer.

- Advised on the IPOs and ASX listings of Cleo Diagnostics, James Bay Minerals, Pioneer Lithium, Infini Resources and CGN Resources.

We advised clients across a range of industries on both domestic and cross border M&A transactions, including:

- Advised Barrick Resources in its negotiations with the Independent State of Papua New Guinea regarding the successful reopening of the Porgera Gold Mine.

- Acted for the Founder, CEO and largest shareholder of ASX-listed ELMO Software Limited on the agreed $486 million acquisition of ELMO by US based K1 Investment Management, LLC.

- Advised MA Financial Group on the $225 million acquisition of the d’Albora Marinas business, comprising a total of 10 marinas from Balmain Asset Management.

- Advised Birdwood Energy on the formation of the Birdwood Distributed Energy Platform and the investment in the platform by Aware Super, valued at $2 billion.

- Advised Firefly Metals (previously AuTECO Minerals Ltd) on its acquisition of the Green Bay Copper-Gold Project in Newfoundland, Canada and associated capital raising.

- Advised Sichuan Road and Bridge Group on its USD166 million acquisition of the Colluli Potash Project in Eritrea from Danakali Limited.

- Advised IPD Group on its $101 million announced acquisition of CMI Operations from Excelsior Capital Limited.

- Advised Fenix Resources on its acquisition of Mount Gibson’s mid-west iron ore and port assets

Congratulations to our Capital Markets and Corporate teams, and a big thank you to everyone for their dedication, hard work and commitment to excellence. Our continued growth and expanding market presence are a testament to the collective efforts of our teams and supportive clients.