The COVID-19 Omnibus (Emergency Measures) Act 2020 (VIC) (Act) which came into effect on 25 April 2020 allowed regulations to be made to temporarily amend certain Acts, including the Retail Leases Act 2003 (VIC) (Retail Act) for the purpose of responding to the COVID-19 pandemic.

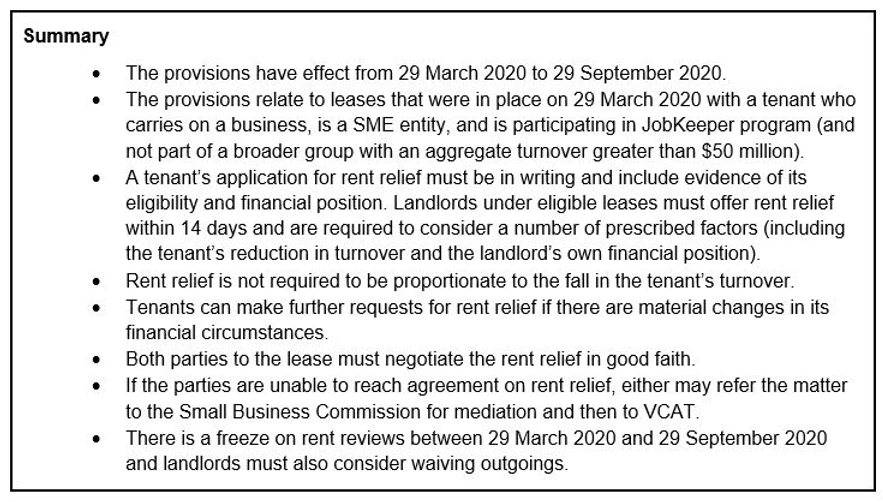

The COVID-19 Omnibus (Emergency Measures) (Commercial Leases and Licences) Regulations 2020 (VIC) were released on 1 May 2020 (Regulations) but operate retrospectively from 29 March 2020 until 29 September 2020 (relevant period).

The objectives of the Regulations are to implement:

- temporary measures to apply to tenants and landlords under certain eligible leases to mitigate the effect of measures taken in response to the COVID-19 pandemic; an

- mechanisms to resolve disputes concerning eligible leases.

Application of the Regulations to Eligible Leases

What is an eligible lease?

The Regulations apply to retail leases (as defined under the Retail Act) and non-retail commercial leases and licences that come within the definition of an ‘eligible lease’ (as defined in the Act), being a lease or licence:

1. that is in effect on 29 March 2020; and

2. under which the tenant is, on or after 29 March 2020,

- an SME Entity; and

- an employer who qualifies for, and is a participant of, the Jobkeeper scheme.

The Regulations (and the Act) exclude some other categories of leases and licences, in particular:

- Where the premises are wholly or predominantly used for agricultural and other related activities, including activities described as ‘farming operation’ in the Farm Debt Mediation Act 2011(VIC).

- Where the tenant is ‘connected’ with or is an ‘affiliate’ of entities and the total aggregate turnover is more than $50 million (see below for further details).

- Where an entity has a prescribed method of control or influence, through the holding of a prescribed interest, right or power, in relation to acts or decisions relating to the ownership, management or affairs of the tenant that is a body corporate. To date, no such method of control has been prescribed by the Regulations.

Who is an SME Entity?

A tenant is an SME Entity at a time in a financial year (the current year) if:

1. the tenant carries on a business in the current year, or is a non-profit body during the current year; and

2. one or both of the following applies:

- the tenant’s annual turnover for the current year is likely to be less than $50 million;

- the tenant carried on a business in the financial year (the previous year) before the current year, or was a non-profit body during the previous year, and its annual turnover for the previous year was less than $50 million.

How is turnover determined?

The Regulations clarify that for the purpose of determining the tenant’s turnover:

- If the tenant is a member of a group of entities that is connected within the meaning of section 328-125 of the Income Tax Assessment Act 1997 (Cth), the turnover is the group turnover.

- If another entity is an affiliate of the tenant, within the meaning of section 328–130 of the Income Tax Assessment Act 1997(Cth), the turnover is the aggregate turnover of the tenant and the other entity.

Rent relief and outgoings provisions

The Regulations impose the following provisions in respect of rent relief and outgoings for ‘eligible leases’:

Tenant’s request for rent relief: A tenant may request rent relief by making the request in writing, which must be accompanied by:

- a statement that the tenant’s lease is an eligible lease and is not excluded from the operation of the Regulations under section 13(3) of the Act (which excludes leases or licences where aggregated turnover of the tenant and its connected or affiliated entities exceeds $50 million and where an entity has control or influence over the tenant as mentioned above); and

- information that evidences that the tenant: (i) is an SME Entity; and (ii) qualifies for, and is a participant of, the Jobkeeper scheme.

Landlord’s obligations to offer rent relief: The landlord must offer rent relief to the tenant within 14 days after receipt of a tenant’s request which conforms with the requirements of the preceding paragraph (valid rent relief request), or a different time frame as agreed between the parties in writing. The landlord’s offer must:

- be based on all the circumstances of the eligible lease;

- relate to up to 100% of the rent payable during the relevant period, of which at least 50% must be in the form of a waiver of rent, unless the parties otherwise agree in writing;

- apply to the relevant period; and

- take into account: (i) the reduction in a tenant’s turnover associated with the premises during the relevant period; and (ii) any waiver of outgoing or other expense payable for any part of the relevant period that the tenant is not able to operate its business; and (iii) whether a failure to offer sufficient rent relief would compromise a tenant’s capacity to fulfil the tenant’s ongoing obligation under the eligible lease, including the payment of rent; and (iv) a landlord’s financial ability to offer rent relief, including any relief provided to a landlord by any of its lenders as a response to the COVID-19 pandemic; and (v) any reduction to any outgoings charged, imposed or levied in relation to the premises.

Good faith: Following receipt of a landlord’s offer by a tenant, both parties must negotiate in good faith with a view to agreeing on the rent relief to apply during the relevant period.

Rent relief agreement: The rent relief arrangements agreed between the parties can be either made in the form of a variation to the lease or a separate agreement between the parties.

Moratorium: Provided that the tenant has made a valid rent relief request (as defined above) or paid rent in accordance with any rent relief agreement made between the parties, the tenant is not in breach if they do not pay rent during the relevant period and:

- the landlord must not evict or attempt to evict the tenant;

- the landlord must not re-enter or otherwise recover, or attempt to re-enter or otherwise recover, the premises; and

- the landlord must not have recourse, or attempt to have recourse, to any security relating to the non-payment of rent (including seeking to enforce any indemnity).

A landlord who contravenes the above provisions is subject to a fine of 20 penalty units (equivalent to $3,304.40 as at 1 July 2019).

Subsequent rent relief: If the financial circumstances of a tenant materially change after the parties have entered into the rent relief agreement, the tenant may make a further request for rent relief (which must be a valid rent relief request) and the process in the preceding paragraphs will apply, except the landlord does not have to offer any further 50% rent waiver.

Payment of deferred rent: If rent is deferred:

- the landlord must not request payment of that deferred rent until the earlier of: (i) the expiry of the relevant period; and (ii) the expiry of the term of the lease.

- unless the parties agree otherwise in writing, the parties must vary the lease or otherwise agree that the tenant must pay the deferred rent to the landlord amortised over the greater of: (i) the balance of the term (including any extension); and (ii) a period of no less than 24 months.

- The landlord cannot require a tenant to pay interest or any other fee or charge in relation to any payment of deferred rent or an agreement made to reflect the rent relief arrangements.

Outgoings and other expenses:

- Tenants have no entitlement to a reduction in outgoings but landlords must consider waiving recovery of any outgoing or other expense payable by the tenant for any part of the relevant period that the tenant is not able to operate their business at the premises.

- If a tenant is not able to operate their business at the premises for any part of the relevant period, the landlord may cease to provide, or reduce provision of, any service at the premises: (i) as is reasonable in the circumstances; and (ii) in accordance with any reasonable request of the tenant.

- If the amount of any outgoings payable by the landlord are reduced: (i) the landlord must not require a tenant to pay any amount in respect of that outgoing that is greater than the tenant’s proportional share of the reduced outgoing payable; and (ii) if the tenant has already paid an amount that is more than its proportional liability for the reduced outgoing, the landlord must reimburse that excess amount.

What are the other provisions relevant to lessors and lessees?

The Regulation also introduces the following key measures relating to ‘eligible leases’:

Good faith: Landlords and tenants must cooperate and act reasonably and in good faith in all discussions and actions associated with matters to which the Regulations apply.

Freeze on rent increases: Rent (other than where the rent is determined by reference to the volume of trade of the tenant’s business) must not be increased during the relevant period unless the parties agree otherwise in writing.

Extension of term: The landlord must offer the tenant an extension of the lease for a period equivalent to the period for which rent is deferred on the same terms and conditions that applied before the commencement of the Regulations.

Change in trading hours: A tenant is not in breach of the lease if during the relevant period:

- the tenant reduces the opening hours of the business; or

- the tenant closes the premises and cease to carry out any business at the premises.

The moratorium on the landlord’s rights in respect of a breach to pay rent during the relevant period and the penalty on landlord’s breach will also apply in these circumstances.

Confidentiality: A landlord or tenant must not divulge or communicate protected information (defined to mean personal information and information relating to businesses or financial information, including information about the trade of a business) obtained under or in connection with the operation of the Regulations except in the circumstances prescribed by the Regulations.

Dispute Resolution – mediation

- A landlord or tenant may refer a dispute about the terms of an eligible lease arising in relation to a matter to which the Regulations apply to the Small Business Commissioner for mediation.

- The dispute resolution provisions of the Retail Act will apply as if the dispute was a retail tenancy dispute within the meaning of that Act.

- Mediation is not limited to formal mediation procedures and extends to preliminary assistance in dispute resolution, such as the giving of advice to ensure each party is fully aware of their rights and obligations and there is full communication between the parties.

- The parties must not use mediation to prolong or frustrate reaching an agreement.

- The landlord or tenant may be represented by a legal practitioner in a mediation but the mediator may, if they consider it appropriate to do so, meet with the landlord or the tenant (alone or together with the other party) without their legal representatives being present.

VCAT or court: Proceedings (other than an order for an injunction) may only be brought before VCAT or a court (other than the Supreme Court) if the Small Business Commissioner has certified that mediation has failed, or is unlikely to resolve the dispute. In making an order, VCAT must have regard to the same matters a landlord is required to have in making a rent relief offer to the tenant.

Supreme Court: Proceedings (other than an order for an injunction) may only be brought before the Supreme Court) if the Small Business Commissioner has certified that mediation has failed, or is unlikely to resolve the dispute, or the landlord or tenant has sought leave to commence proceedings in the Supreme Court and leave has been granted.

Considerations/practical implications

- The relief measures prescribed by the Regulations apply generally to both retail leases and non-retail leases and licences (other than leases for agricultural or other similar purposes).

- The National Cabinet’s Mandatory Code of Conduct (Code of Conduct) states that the $50 million turnover threshold is applied at the franchisee level but this is not the case with the Regulations. In respect of leases granted by a landlord to a franchisor over which the franchisor has granted a licence to its franchisee to operate the business from the premises, the effect of the Regulations is that the franchisor tenant may not be entitled to rent relief from its landlord (because its turnover is over $50 million), but between the franchisor and the franchisee, the franchisee may be entitled to seek rent relief from the franchisor.

- The Regulations not only require a tenant to be eligible for, but also to be a participant of, the Jobkeeper scheme. Tenants are also required to provide information to evidence this at the time the tenant makes a request for rent relief to the landlord. Given that Jobkeeper payments are not due to start until May 2020, it is not clear whether tenants who have not received any payments or other confirmation that they are eligible for the Jobkeeper program can prove they are participating in that scheme by providing evidence that tenants have applied for the scheme.

- It is also unclear what financial information tenants are required to provide when requesting rent relief from landlords. The Small Business Commissioner is expected to publish guidelines on this shortly,

- Given the retrospective operation of the Regulations, it is unclear whether landlords who have, for example, drawn down a bank guarantee after 29 March 2020 in respect of the tenant’s failure to pay rent during a period which falls within the relevant period, will be subject to the fine of 20 penalty units and/or be required to restore the bank guarantee.

- Certain landlords may find the requirement to offer rent relief within 14 days after receiving a request for rent relief by the tenant challenging. Landlords, especially those with a large portfolio, should consider requesting tenants allow them a longer time frame to consider their rent relief requests. Tenants should consider agreeing to this, especially given the Regulations require both parties to act reasonably and in good faith.

- The Code of Conduct requires rent relief to be granted in the form of (at least 50%) rent waivers and rent deferrals. The Regulations adopts the requirement for at least 50% rent waiver, but suggests the remaining 50% rent relief may be in the form of a rent reduction, remission or deferral of rent. Unlike the Code of Conduct, while the Regulations requires landlord to take into account the reduction in a tenant’s turnover associated with the premises during the relevant period, the Regulations do not require the rent relief to be proportionate to the reduction to the tenant’s turnover.

- The Code of Conduct states that leases must be dealt with on a case-by-case basis as leases have different structures. The Regulations appear to have adopted this principle as a landlord’s offer of rent relief must ‘be based on all the circumstances of the eligible lease’. While it is still unclear how this will work practically, this will enable landlords to take into account the peculiarities of each lease in making a rent relief offer, such as whether there is already a rent free period under the lease for all or part of the relevant period.

- Like the Code of Conduct, the landlord must take into account, in making its offer, whether a failure to offer sufficient rent relief would compromise the tenant’s capacity to fulfil their ongoing obligations under the lease and the landlord’s financial ability to offer rent relief, including any relief provided to a landlord by its lenders as a response to the COVID-19 pandemic. However, unlike the Code, the Regulations do not require landlords to pass on to tenants any benefits it receives due to deferral of loan payments.

- Landlords must consider waiving outgoings (the Regulations do not limit this to statutory outgoings but also include repair and maintenance expenses of the premises or the building in which the premises are located) if the tenant is not able to operate their business at the premises. It is unclear whether this also applies to tenants who voluntarily close their business even though they are not required to do so by the government.

- Landlords may also cease to provide, or reduce, the provision of any service at the premises if the tenant is not able to operate their business but only if it reasonable and in accordance with any reasonable request of the tenant. Landlords may have obligations under leases to provide ongoing services to tenants (especially leases subject to the Retail Act) and should be aware that they cannot unilaterally reduce the provision of any service just because a tenant has closed its business.

- The Regulations prevent landlords from drawing down bank guarantees or evicting tenants who have closed their business or reduced their opening hours during the relevant period. However, unlike the preceding paragraph, this prohibition applies as long as tenants have reduced their opening hours or closed the premises, regardless of whether or not the tenants were required to do so by the government.

- Tenants may make a further request for rent relief if their financial circumstances materially change during the relevant period. It is unclear what constitutes a material change. The requirement for landlords to offer at least 50% rent waiver will not apply.

- If the parties reach an agreement on rent relief arrangements (whether by a deed of variation of the lease or a separate agreement) and tenants subsequently fail to pay the agreed rent, the Regulations lift the moratorium on landlords’ rights and allows landlord to draw down bank guarantee and/or evict those tenants.

If you would like to discuss the contents of this article or have any questions about the impact of current events on your business, please contact John Frangi, Partner, Marcus Cutchey, Partner or Brendan Ivers, Partner.

About Hamilton Locke

Hamilton Locke is one of Australia’s fastest growing law firms and now in the top 50 firms nationally. Over the past year the firm has grown 200%, from five to 16 partners, and from 13 to 50 lawyers and staff.

Hamilton Locke is a multi-award winning full service corporate and commercial law firm covering M&A, property, banking, restructuring, funds management and litigation. With talent from some of the top law firms globally, we believe in the relentless pursuit of success for our clients. That is why we have grown an organisation of energised people, propelled by class leading technology, who are freed up from bureaucracy and administration to really focus on doing what they do best – solving complex client problems.