This article is part of our Disputes in M&A: 5 key trends for 2022 and beyond series: a collaboration between our market leading Corporate and Dispute Resolution teams.

Background

Disputes arising from Mergers and Acquisitions (M&A) transactions are not confined to disputes between buyers and sellers. Issues overlooked early in the lifecycle of a company can – and often do – cause disputes between a target company and its shareholders. It’s therefore critical for founders and investors to understand contractual terms which will affect their ability to ultimately realise their investment. This article series continues by evaluating issues as they arise upon the establishment of a company and specifically assesses the nature and effect of pre-emptive rights which can be agreed upon between a company and its members.

Defining Pre-Emptive Rights

A pre-emptive right provides a shareholder the right to obtain existing or freshly issued shares in the company (on a pro-rata basis to their existing holdings) in priority to a third-party acquirer. The effect of pre-emptive rights on a transaction must be considered by the company and its shareholders prior to considering transactions which could alter its share structure.

Unless modified or replaced in a company’s constitution, section 254D of the Corporations Act 2001 (Cth) provides a statutory default requiring a proprietary company to offer existing shareholders the ability to acquire an issue and allotment of new shares (of the same class). Shareholders of a listed company do not have statutory pre-emptive rights.1 These statutory pre-emptive rights are rarely enlivened due to the displacement of the replaceable rules (including section 254D) by a company’s constitution. Rules having substantially the same effect can sometimes be included in a company’s constitution.

Alongside a company’s constitution, pre-emptive rights are most commonly contained in shareholder or joint venture agreements. Here, it is critical for the company to review these documents and ensure that if pre-emptive rights are present, that the effect of the clauses are understood. Failing to understand contractual obligations attaching to pre-emptive rights can prove fatal to a transaction, especially when, as is often the case, time is of the essence.

How Pre-Emptive Rights Affect M&A

In an M&A context, we see disputes about pre-emptive rights commonly arise regarding:

- the enforceability of invalid pre-emptive rights notices;

- Right of First Refusal and Right of Last Refusal; and

- transferring shares in contravention of an enforceable pre-emptive right.

Below we consider the circumstances in which these issues arise in practice, how the courts have historically resolved the issues and provide some practical takeaways.

1. Issuing an invalid pre-emptive right notice

Pre-emptive rights provisions in shareholders agreements and joint venture agreements are usually quite prescriptive as to the form and content of notices which must be given by a proposed seller of shares to its fellow shareholders or joint venture participants. Disputes often arise where a notice purported to have been given in accordance with pre-emptive rights provisions is either not accepted, or later deemed invalid, as a result of not complying with the prevailing requirements of the governing documents.

This is what happened in the decision of Santos Offshore Pty Ltd v Apache Oil Australia Pty Ltd2 where a notice issued advising of a prospective share sale (and change in control) to a third-party was deemed invalid by the court because it imposed terms and conditions which were in addition to and inconsistent with the pre-emptive rights clause in the parties’ joint venture agreement.3 Specifically, the notice:

- detailed a method for calculating the purchase price which was inconsistent with the method defined under the joint venture agreement; and4

- imposed additional conditions which were not relevant to the interest being transferred.5

The Santos decision serves as a reminder that notices must strictly accord with the terms of the pre-emptive rights clause. This, however, can be difficult if the pre-emptive rights clause is drafted in a manner which is unclear or open to interpretation by the parties.

2. Rights of First Refusal and Rights of Last Refusal

How and when a pre-emptive rights clause is triggered rests entirely on its drafting. In practice, how a pre-emptive rights clause is drafted turns on how the parties wish for the priority mechanism to operate and whether they intend to market-test the price of the shares before allowing an offer to be made to existing shareholders. Generally speaking, pre-emptive right clauses are more favourable to either the selling shareholder/joint venture participant or to the remaining shareholders/joint venture participants.

The simplest approach is the ‘right of first refusal’ structure (ROFR or Right of First Refusal). Taking a shareholders’ agreement as the relevant context, a selling shareholder must first offer its shares to the remaining shareholders at a price set by it before seeking interest from third-parties. If the remaining shareholders reject the offer, then the seller is permitted to offer the shares to a third party on terms no more favourable (including price) than the terms of the offer.

In contrast, for parties who prefer to have the price of the sale shares determined by a market-based mechanism, a ‘right of last-refusal’ (ROLR or Right of Last Refusal) is best. A selling shareholder must first have received a binding offer from a third party for their shares which they must then take to the remaining shareholders who shall have the right to refuse or accept the offer of the sale of shares on the same terms as the third party offer.

A Right of First Refusal is generally more favourable to minority shareholders wishing to sell because under a Right of Last Refusal mechanism it can be difficult to obtain a binding offer for the sale interest in circumstances where third parties are aware that existing shareholders have the last right to acquire the sale interest on the same terms. Buyers may not wish to go to the time and expense of negotiating a transaction only to be left empty-handed when an existing shareholder exercises its pre-emptive rights.

Although ROFR and ROLR are the most common forms of pre-emptive rights on transfer, there is no hard and fast rule in drafting pre-emptive rights – parties must negotiate and come to agreed terms.

3. Transfers in contravention of pre-emptive rights – legal title and competing equitable proprietary interest

If a valid notice under a pre-emptive rights provision is issued and the pre-emptive rights clause is unequivocal, what happens when shares are transferred in contravention of that pre-emptive right?

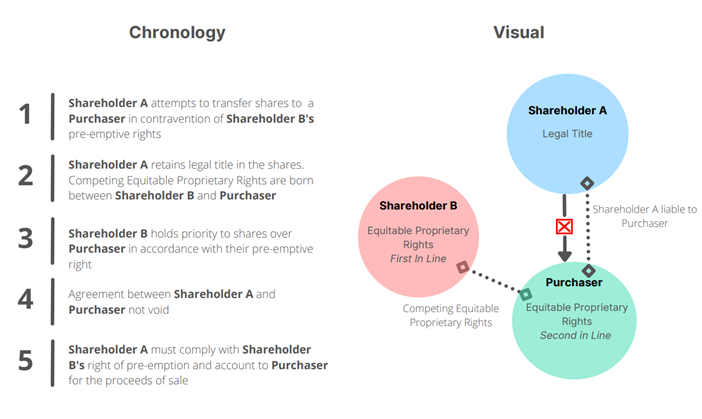

As decided in Rathner v Lindholm & Ors6, legal title in shares will not pass from a selling shareholder to a purchaser when an enforceable pre-emptive right is not discharged. Rather, legal title remains with the selling shareholder and competing equitable proprietary interests are born between the purchaser and shareholder who holds a right of pre-emption. The equitable interest of the existing shareholder with a right of pre-emption will almost always prevail, and the selling shareholder will be liable to sell its interest to the existing shareholder and then account to the purchaser for the consideration it paid under the original transaction.7

The following diagram provides a visual representation of how competing equitable proprietary interests and legal title play out in practice

Practical takeaways

Uncertainty often acts as the catalyst for disputes between contracting parties. Fortunately, the common disputes detailed in this article can mostly be avoided through careful consideration of pre-emptive rights provisions during drafting of governing documents, proper due diligence and compliance with pre-emptive rights during transactions: Identify if a pre-emptive right exists, understand how it’s drafted, who it catches and under what circumstances it will apply and to whom.

The best way to mitigate potential disputes is to spend time drafting pre-emptive right clauses clearly and in a manner which reflects the intentions of the parties. For companies currently engaged or soon to be engaged in a transaction affecting their share structure, the Santos decision serves as a reminder to strictly adhere to the requirements in a pre-emptive rights clause.

Pre-emptive rights have been and will continue to be hotly disputed in the M&A space. Although the cases discussed in this article provide an idea of how these issues may be resolved, transactional disputes are highly fact-sensitive and turn on varying issues, some are immediately obvious, some are not, but most can be managed if proactively addressed. To this end, the old adage an ounce of prevention is worth a pound of cure should be kept front of mind for companies to best manage risks and ensure a smooth transaction.

1Although, in a similar respect, consent from shareholders is required under the ASX Listing Rules should the company wish to issue more than 15% (or 25% for small companies) of its shares in a 12-month period.

2[2015] WASC 242.

3Santos Offshore Pty Ltd v Apache Oil Australia Pty Ltd [2015] WASC 242 [82], [83].

4Santos Offshore Pty Ltd v Apache Oil Australia Pty Ltd [2015] WASC 242 [2015] WASC 242 [82].

5Santos Offshore Pty Ltd v Apache Oil Australia Pty Ltd [2015] WASC 242 [2015] WASC 242 [89].

6[2005] VSC 399 at 102.

7Rathner v Lindholm & Ors [2005] VSC 399 at 102.