In our previous three-part series (Part I, Part II and Part III) and recent article, we examined the upcoming changes to the National Electricity Rules (NER) through the introduction of the National Electricity Amendment (Integrating Energy Storage Systems into the NEM) Rule 2021 (IESS Rule) and the National Electricity Amendment (Implementing Integrated Energy Storage Systems) Rule 2023 (2023 Rule) (together, the Rules).

The Rules will create a new market participant registration category in the National Electricity Market (NEM) called the Integrated Resource Provider (IRP). The Rules are scheduled to take effect in June 2024.

In this article, we recap on what the Rules mean for participants in the NEM and examine:

- Which participants are affected;

- What needs to be done (if anything);

- When it needs to be done by; and

- How to do it.

What is an Integrated Resource Provider?

An IRP is a new market participant registration category in the NEM which will allow storage and hybrids to register and participate in a single registration category rather than under two separate categories. In the past, participants who wished to both export and import energy (e.g. battery energy storage systems) had to register both as a Generator and as a Customer.

In particular, IRP participants will be able to classify the following systems, many of which are examples of Integrated Resource Systems, a new definition introduced by the Rules (see Definitions section, below):

- storage (bi-directional units);

- units within hybrid systems;

- DC coupled units;

- aggregated portfolios;

- generating units; and

- scheduled load and even retail load (end user connection points).

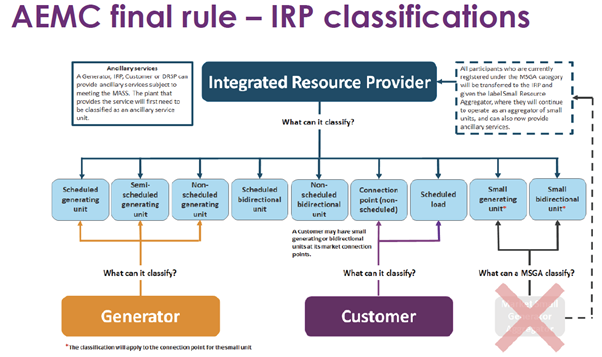

The below chart provides a comprehensive overview of the assets that can be classified under the IRP category, as well as illustrates the traditional classifications for Generators, Customers and Market Small Generator Aggregators (MSGA).

Source: AEMO

Do I need to register as an IRP?

The table below sets out the registration process and deadlines for the given categories of NEM participants.

Key takeaways:

- Generators and Customers must self-identify to AEMO if they are seeking to move into the IRP registration category, in which case they must complete their application by 3 September 2024 and complete registration by 3 December 2024. Registration is not mandatory for these categories.

- MSGA and NEW IRS Participants will automatically be registered on and from 2 and 3 June 2024, respectively.

- Existing IRS Participants must apply to transfer registration by:

-

- 35 business days prior to its BDU cutover date; or

- 3 September 2024 at the latest,

and complete registration by 3 December 2024.

- Future IRP Participants must apply to AEMO using a specific IRP transition registration form.

| Generator | Customer | MSGA | Existing IRS Participant | New IRS Participant | Future IRP Participant | |

| Is registration mandatory? | No, but they may choose to. | No, but they may choose to. | Yes | Yes | Yes | Yes |

| Is registration automatic? | No | No | Yes | No | Yes | No |

| Implementation date for automatic registration | N/A | N/A | 2 June 2024 | N/A | 3 June 2024 | N/A |

| Registration application deadline | 3 September 2024 | 3 September 2024 | N/A | 35 business days prior to BDU cutover date, or

3 September 2024 latest |

N/A | N/A |

| Registration completion deadline | 3 December 2024 | 3 December 2024 | N/A | 3 December 2024 | N/A | N/A |

Definitions

| Definitions | |

| Bi-directional Unit (BDU) | A production unit that also consumes electricity. Consumption of electricity:

|

| Customer | A registered participant that purchases electricity supplied through a transmission or distribution system to a connection point. |

| Existing IRS Participant | A participant with an IRS registered prior to 9 December 2021. |

| Future IRP Participant | A participant with an IRS completing registration on and from 3 June 2024. |

| Integrated Resource System (IRS) |

|

| Generator | A registered participant engaged in the activity of owning, controlling or operating a generating system in the NEM. |

| Market Small Generator Aggregator (MSGA) | A registered participant who can supply electricity aggregated from one or more small generating units, which are connected to a distribution or transmission network. |

| New IRS Participant | A participant with an IRS registered between 09 December 2021 and 02 June 2024. |

Source: AEMO

Reference Materials

Participants should carry out a full assessment of the classification of their assets in consultation with the current AEMO Classification Guide and incoming Classification Guide from IESS commencement (03 June 2024).

Worked example

BESS Pty Ltd owns and operates a 500MW BESS (the Facility) which was registered in November 2021. The Facility was classified as a Scheduled Operating Unit and a Scheduled Load. The associated registration is that of a Market Generator and a Market Customer. Pursuant to the Rules, the Facility must now be classified as a Bi-directional Unit which can only be classified by an IRP. Due to the timing of the Facility’s existing registration, it will be considered an Existing IRS Participant.

Therefore, BESS Pty Ltd must:

- apply to transfer registration by at least 35 business days prior to its BDU cutover date or by 3 September 2024 latest, and

- complete its IRP registration by 3 December 2024.

How to register as an IRP

Once the assessment is complete, to register as an IRP, participants must fill out a registration form (if required), pay the relevant fee (if any) and update business processes and systems accordingly.

Registration Forms

- MSGAs and New IRS Participants will not be required to complete an application form, but may be required to provide additional information to AEMO to complete the registration.

- Existing IRS Participants should have received IRP transfer of registration documentation to complete in February 2024.

- Future IRS Participants should have access to the IRP registration form from mid-May 2024. Future IRS participants who wish to start the registration process before the form is available should contact the AEMO onboarding team: onboarding@aemo.com.au.

In each case, AEMO will:

- enable affected participants to undertake test activities under the new registration category;

- register or re-register the participant (subject to receiving satisfactory and complete information);

- notify the participant immediately beforehand that registration or re-registration is occurring; and

- notify the participant immediately after that registration or re-registration is complete.

Registration Fees

New and Existing IRS Participants will not be charged a registration fee by AEMO for transitioning to the IRP category. However, future IRS Participants should consult the fee schedule of new registrations in the AEMO FY Budget and Fees document (published annually).

Update Business Processes and Systems

All IRS participants need to ensure that they update and develop appropriate business processes and systems in order to be IESS ready. AEMO has advised that participants should refer to AEMO’s:

- Registration forms and guidance;

- Market IT information, including technical specifications;

- Market procedures;

- IESS project’s readiness information (including the IRP Transition Plan, BDU Transition and Cutover Plan, IESS NCC transition plan and IESS June 2024 Go-live plan); and

- IESS projects market industry testing and market trial information.

Need assistance?

If you are unsure where your project stands, or to stay informed on the evolving challenges and opportunities in the renewable energy sector, please reach out to our experts Matt Baumgurtel and David O’Carroll or our New Energy team.